Coca-Cola, Altria Group, and Meta Platforms are set to trade ex-dividend on 6/14/24, with each company preparing to pay out their respective upcoming dividends. Coca-Cola will pay a quarterly dividend of $0.485 on 7/1/24, Altria Group will pay a quarterly dividend of $0.98 on 7/10/24, and Meta Platforms will pay a quarterly dividend of $0.50 on 6/26/24. Investors can expect Coca-Cola shares to trade about 0.76% lower, Altria Group shares to open 2.11% lower, and Meta Platforms shares to open 0.10% lower as a result.

Altria Group is inching closer to becoming a “Dividend Aristocrats” index member, as it has over 16 years of consecutive dividend increases. This milestone marks the company as a “future dividend aristocrats contender.” The consistency in dividend increases is a positive indicator of the company’s financial stability and commitment to rewarding shareholders in the long run.

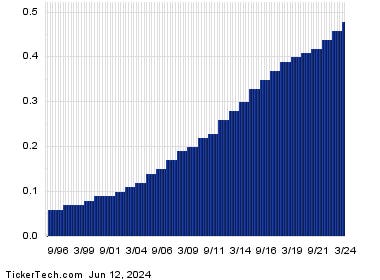

The historical dividend charts for Coca-Cola, Altria Group, and Meta Platforms provide insights into the companies’ dividend payout patterns over time. While dividends are not always guaranteed and can fluctuate based on company performance, analyzing past dividend history can help investors determine the likelihood of future dividend payouts. Currently, Coca-Cola offers an estimated annual yield of 3.05%, Altria Group has a yield of 8.45%, and Meta Platforms has a yield of 0.39%.

Investors interested in income investing can benefit from joining the conversation on platforms like ValueForum.com, where they can exchange insights and strategies for maximizing dividend returns. As of Wednesday trading, Coca-Cola shares are slightly down by 0.1%, Altria Group shares have decreased by 0.2%, and Meta Platforms shares have increased by 1%. Keeping an eye on these top dividend-paying stocks can offer opportunities for consistent income generation.

With the upcoming dividend payments from Coca-Cola, Altria Group, and Meta Platforms, investors have the chance to earn returns on their investments through quarterly dividends. Dividend-paying stocks are favored by income investors for their steady income stream and potential for long-term growth. Analyzing historical dividends and monitoring stock performance can aid investors in making informed decisions about dividend investing and maximizing their returns.

In conclusion, the upcoming ex-dividend dates for Coca-Cola, Altria Group, and Meta Platforms present investors with opportunities to earn dividends on their investments. By examining historical dividend data and tracking stock performance, investors can gauge the stability and growth potential of these companies’ dividend payouts. Joining income investing discussions on platforms like ValueForum.com can provide valuable insights and strategies for maximizing dividend returns in a constantly changing market environment.