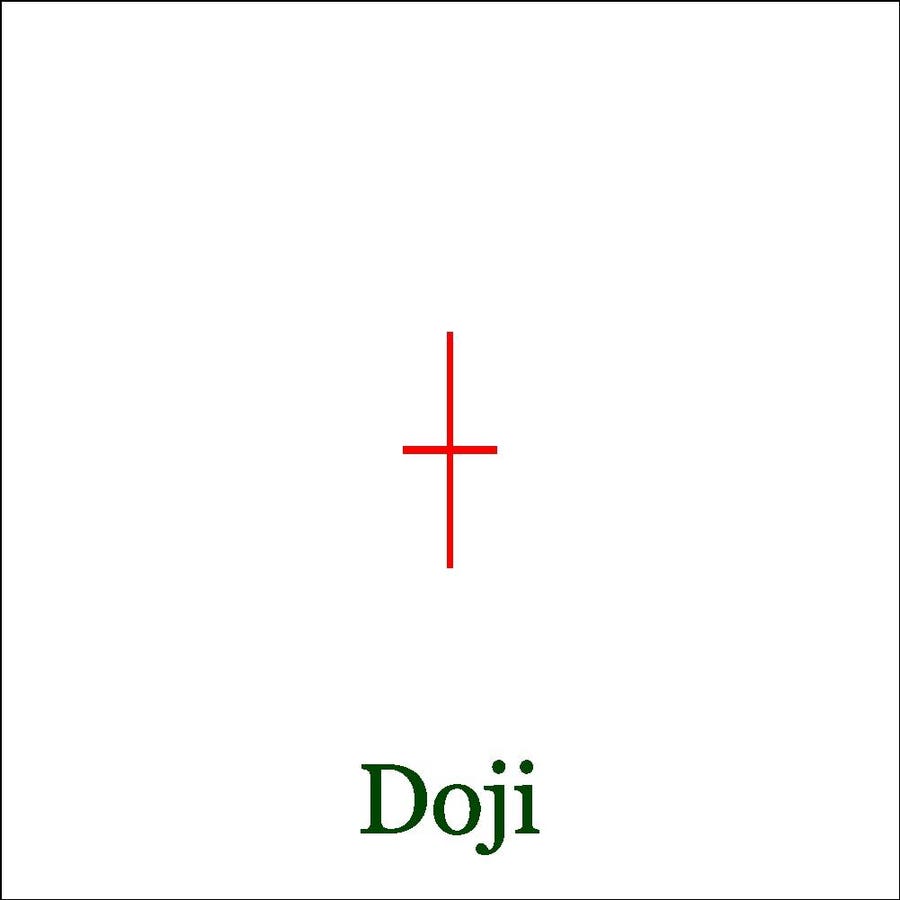

Apple Inc. (AAPL) generated a monthly doji buy signal at the end of May, after the stock closed well above the doji high. The close was 14.8% above the doji low, indicating strength. The monthly starc+ band and yearly R1 are at $215.64 and $219.69, respectively. A close above resistance at $199.62 could lead to upside targets in the $275 area. Volume increased in May, and the DTS and Vol Confirm turned positive. AAPL is showing signs of potential market leadership, but has not yet been confirmed as a market leader.

Despite closing below the week’s high at $192.99, AAPL was up 1.25% for the week. The weekly downtrend was broken three weeks ago, and the new monthly pivot for June is at $184.39. The rising 20-week EMA at $181.32 should provide support levels if AAPL corrects. The weekly RS has moved above its WMA, indicating that AAPL is leading the S&P 500 higher. The OBV has held support at line b and moved above its WMA, suggesting increasing volume as AAPL moves higher. The daily technical studies are also positive, with the rising 20-day EMA at $186.70 signaling potential buying opportunities.

AAPL’s monthly doji buy signal may take 2-3 months to turn profitable, as is typical for new signals. The strength of the signal lies in the close above the doji high and the increase in volume. The signal will remain in effect as long as the doji high is not exceeded. With resistance levels at $199.62 and support levels at the rising 20-week EMA at $181.32, AAPL is poised for potential upside targets in the $275 area. The stock’s performance against the S&P 500, as indicated by the RS and OBV, suggests that AAPL is gaining momentum and could potentially lead the market higher.

Investors should keep an eye on AAPL’s performance in the coming months to see if the monthly doji buy signal turns profitable. The stock’s positive technical indicators and potential market leadership position indicate a bullish outlook. However, investors should be prepared for potential corrections and consider buying opportunities at key support levels. Overall, AAPL’s recent strength and positive signals suggest that the stock could continue to outperform the market and reach upside targets in the near future.