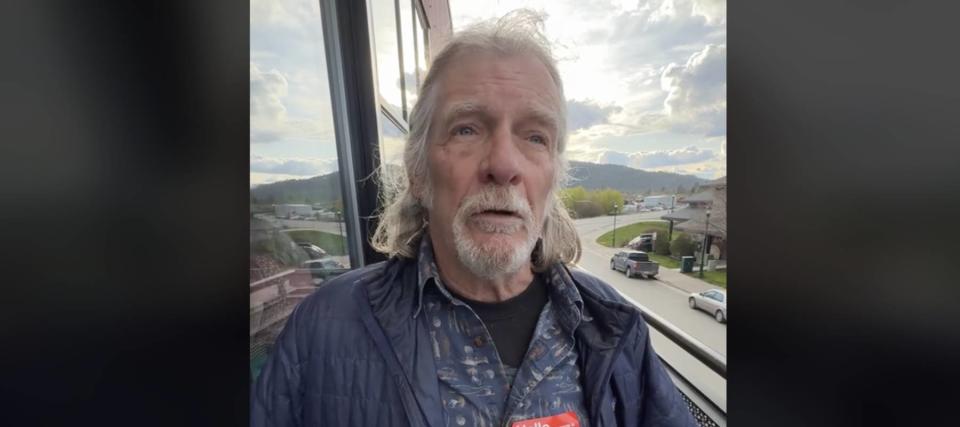

A 68-year-old man from Montana, referred to as Kurt, has spoken out about the burden of property taxes in the state. In a viral speech shared on TikTok by a gubernatorial candidate, Kurt revealed that his annual property taxes have soared from $895 to almost $8,000 in just a few years. This increase of around 790% has left Kurt working well into his retirement years just to cover his mounting property costs. He argues that there should be a moratorium on what homeowners have to pay, as many residents like himself are struggling to keep up with the rising taxes.

The surge in property taxes in Montana can be attributed to the soaring property values in the state. Property taxes are typically based on a percentage of a home’s assessed value, so as property values increase, tax bills tend to go up as well. Kurt claims to have purchased his property in 1995, and over the years, the value of the home has undoubtedly risen significantly. This trend is reflected in the FRED Economic Data’s house price index for Billings, MT, which shows a 272% increase in average house prices since 1995. The COVID-19 pandemic also fueled a surge in housing demand in Montana, leading to further increases in property values and subsequently, property taxes.

While some homeowners in Montana may consider selling their properties and downsizing to manage their tax bills, Kurt is emotionally attached to his family home and intends to stay there until the end. The median residential property owner in Montana saw a 21% increase in property taxes in 2023, with typical increases ranging from 11% to 35%. Property taxes in Montana make up nearly 97% of local tax revenue, compared to the 71% average for local governments nationwide. This heavy reliance on property taxes is possibly due to the absence of state or local sales tax in Montana.

Property taxes in Montana go towards funding essential local government services such as K-12 schools, law enforcement, and fire departments. The state’s department of revenue has promised property tax rebates for eligible homeowners in 2022 and 2023, but a moratorium on taxes similar to what Kurt is advocating for seems unlikely. As inflation and the costs of providing public services continue to rise, some local governments have been forced to raise property tax rates to compensate. Resolving Montana residents’ property tax challenges will likely require a comprehensive approach that addresses the underlying issues contributing to the dramatic increases in property costs.